Case Study - Development of a Student Fintech Application in the United States – Finnt

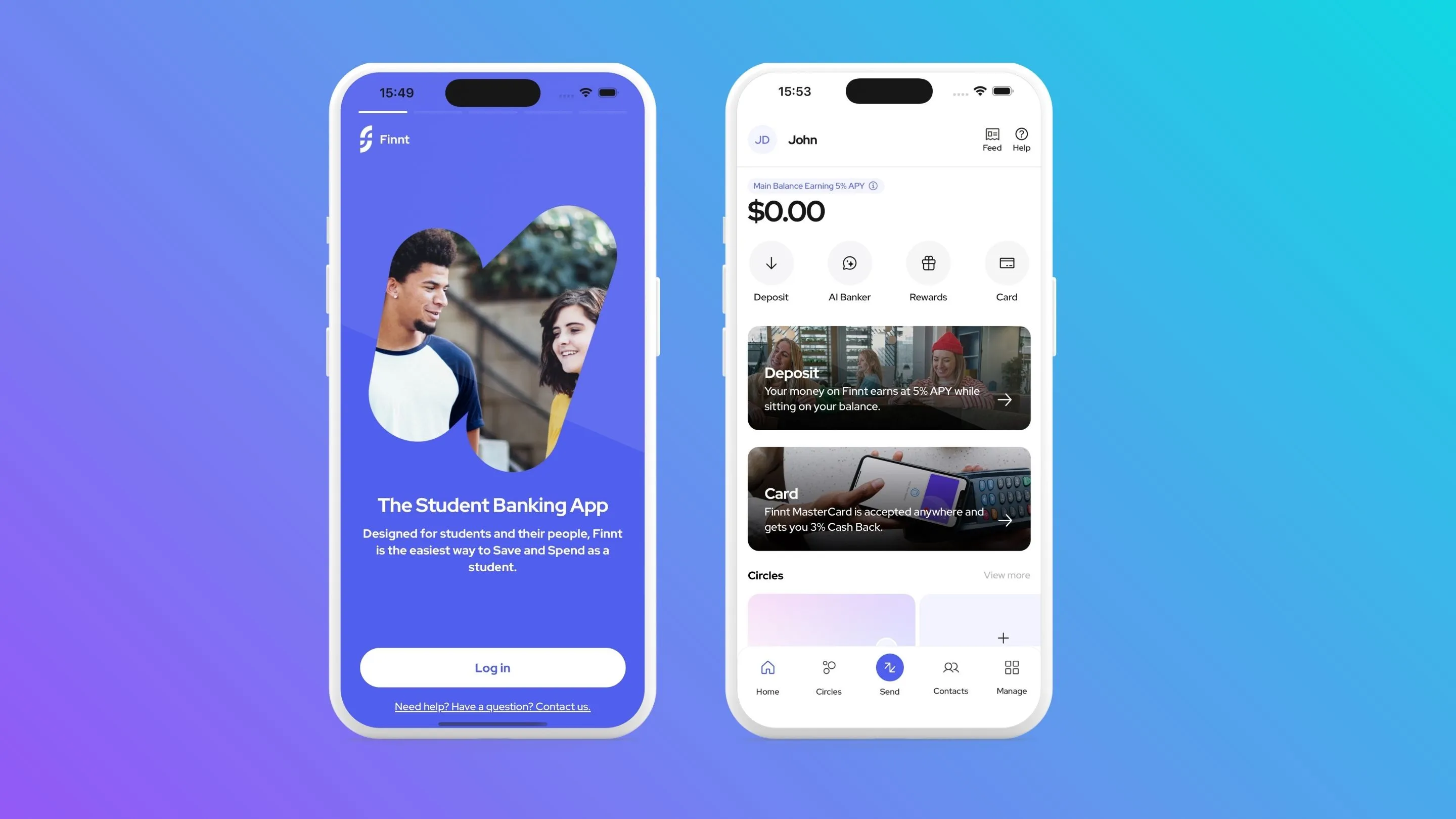

Design and development of a fintech mobile application in the United States: KYC onboarding, bank accounts, payment cards, transactions, and Banking-as-a-Service integration.

- Client

- Finnt

- Year

- Service

- Fintech App Development & UX/UI

Context: building a student fintech for the U.S. market

Finnt targets students across U.S. universities with a clear ambition: deliver a fintech mobile application capable of covering everyday financial use cases in a secure and scalable environment.

The main challenge was to design a full banking infrastructure while maintaining a smooth and accessible user experience.

Fintech architecture & Banking-as-a-Service

Ternatek designed an architecture based on a Banking-as-a-Service model, connecting the mobile application to banking services through dedicated APIs.

This approach enabled:

- creation and management of bank accounts

- issuance and administration of payment cards

- transaction and transfer flows

- secure handling of financial data exchanges

- orchestration of third-party banking services

KYC & onboarding: reducing friction without compromising reliability

A strong focus was placed on user onboarding and KYC flows.

The goal was to minimize friction during signup while maintaining a high level of operational reliability.

The onboarding flow was designed to include:

- identity verification processes

- error handling and edge case management

- clear and progressive mobile UX

- real-time user feedback

Mobile development & UX built for real-world usage

The application was developed with a mobile-first approach, optimized for daily campus usage: fast navigation, clear transaction visibility, shared finance management, and seamless interactions with banking services.

Outcome: a fintech infrastructure built to scale

At the end of the project, Finnt benefits from a robust technical foundation, ready to support product evolution across multiple campuses and sustain platform growth.

This project demonstrates Ternatek’s ability to design and deliver complex fintech applications for demanding international markets, with a pragmatic, scalable, and product-driven approach.

What we did

- Fintech Development

- Banking-as-a-Service

- KYC & Onboarding

- Mobile Banking Infrastructure

- Banking APIs

- US Fintech

- iOS App Development

- Secure Transactions

- KYC completion rate

- ≈ 92%

- Reduction in onboarding friction

- ≈ -40%

- Transaction flow stability

- ≈ 99.9% of operations processed

- User satisfaction

- 4.7/5